Case Study

How BECU Transformed Their Mortgage Loan Experience

July 22, 2020

The situation

Lorraine Stewart joined BECU as the Vice President of Mortgage Lending in January 2014. In her words, the mortgage business at this time was "on fire." Application volume was high, wait times were long, and team morale was falling. More, NPS scores going into that year were down to 45.22. Change was desperately needed — but where to start?

It was actually the perfect time to step back and examine the member experience, says Member Loyalty Group’s Michelle Bloedorn. To gain the full picture, different ‘listening posts’ were engaged, such as surveys, feedback from frontline employees, social media and operational data. Rather than relying on one key metric, she explains, each should be viewed as a window into a different piece of the member experience. Popular measures include customer satisfaction surveys (CSAT), Net Promoter Score (NPS), and ease of use (CES). Bloedorn says that organizations can use root cause analysis to weave these metrics together into a complete narrative. Ultimately, she notes, the scores don’t matter as much as the action that an organization takes in order to improve.

Action

BECU turned a critical eye (and ear) to the information coming in. As the team sorted through the feedback, they were able to identify specific challenges and areas of friction. It didn’t happen overnight, but major changes were implemented that would prove critical to success:

- A reorganization of the mortgage group with clear roles and responsibilities

- A full update of mortgage policies and procedures

- Redesigned trainings for mortgage group employees

- Standardization of BECU’s handling of electronic documents, which had frustrated underwriters.

Member communication improved when BECU started providing loan processors — who had previously been hesitant to contact members — with scripts for difficult conversations. The mortgage group focused heavily on individual NPS as an incentive goal, and leaders reviewed results daily.

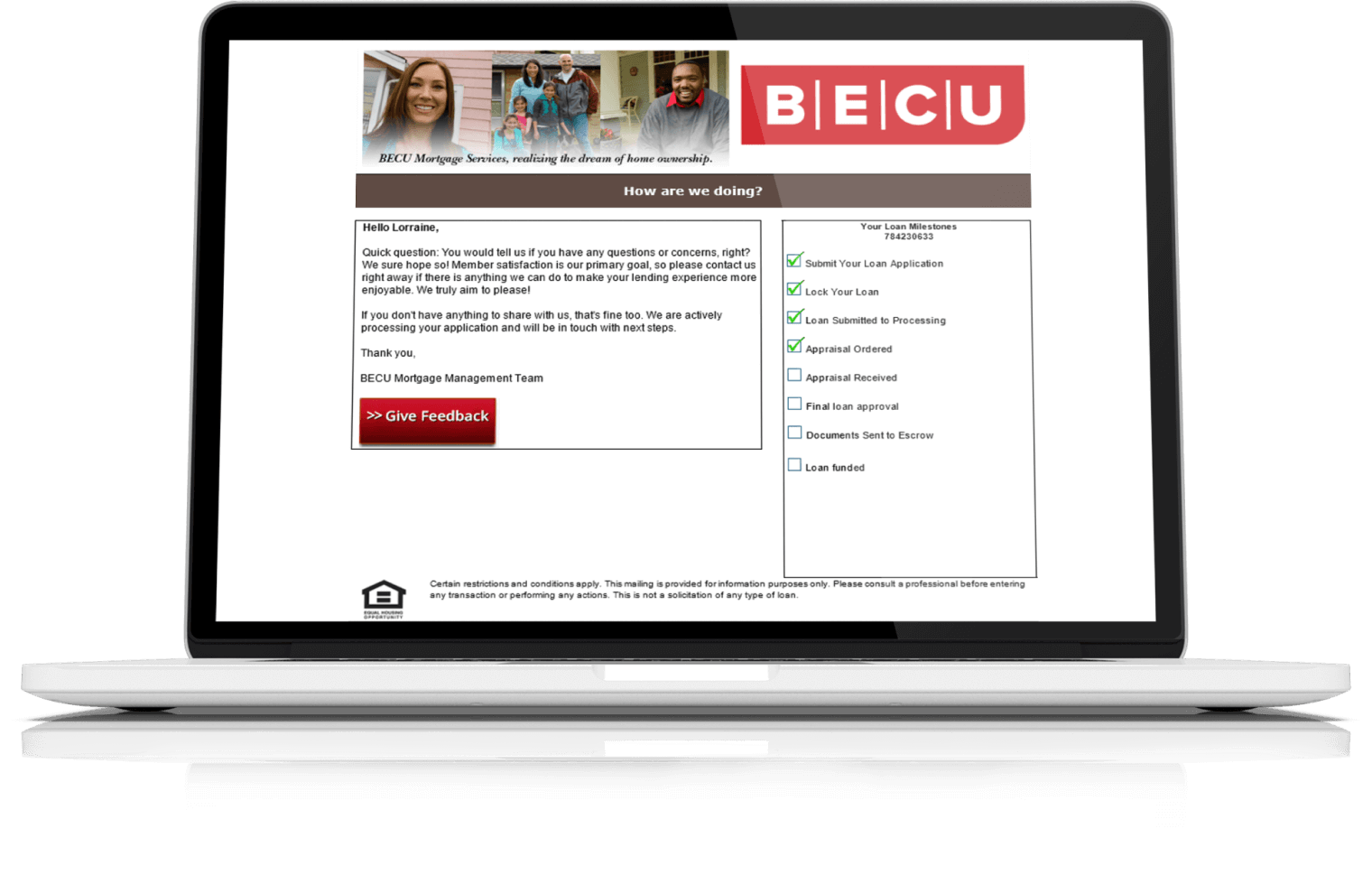

Still happening? They began to send “How are we doing?” emails to each applicant a couple of weeks into their loan process. This provided feedback on whether changes being made to the mortgage process truly resulted in a better member experience. The reporting also helped them identify individuals who need coaching and those to recognize as champions for best practices.

Result

The New Mortgage Experience Heroes

From 2013 to 2019, Stewart reports that BECU’s overall mortgage NPS rose 81%, and their purchase NPS grew by an astonishing 181%. “We’ve come a long way since January 2014,” Stewart claims, adding that in the end, it was very simple - their members had told them everything they needed to know. “It was on us to listen and respond. We love that we’ve been able to create a better experience for our members, and that’s the foundation for everything else.”